Ethereum, the blockchain platform and its associated Ethereum Virtual Machine (EVM) has transformed the world of cryptocurrency and blockchain technology. This article delves into the intricacies of Ethereum, explaining its foundational concepts and exploring its revolutionary potential in various industries.

Understanding Ethereum

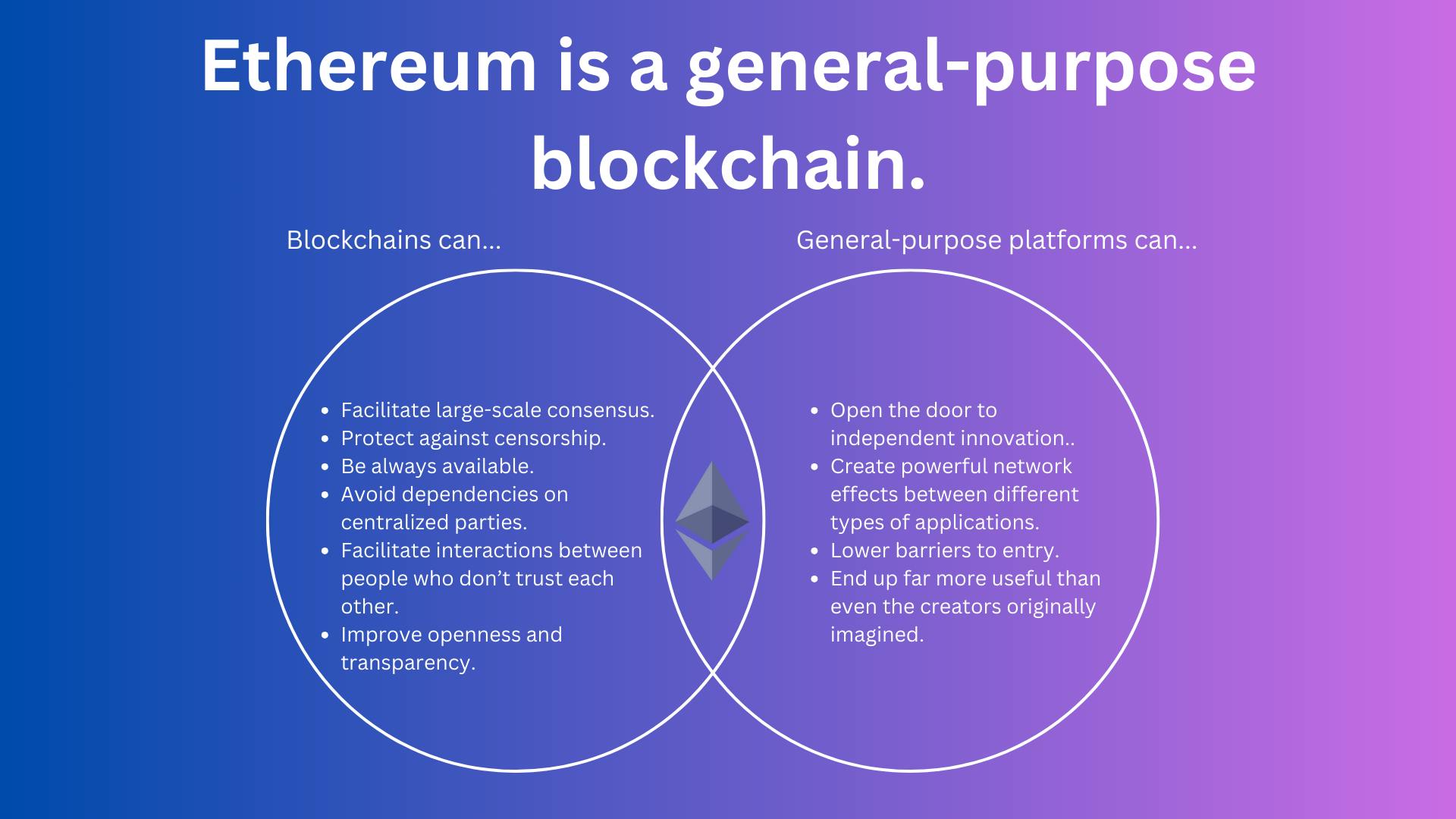

Ethereum, a decentralized, open-source blockchain, was introduced by Vitalik Buterin in 2015. Unlike Bitcoin, Ethereum's primary purpose extends beyond digital currency. It's designed as a platform for decentralized applications (DApps) and smart contracts, enabling users to create and execute programmable contracts on the Ethereum network.

Difference between Bitcoin & Ethereum.

Bitcoin and Ethereum are two of the most prominent cryptocurrencies, but they serve different purposes and have several key differences:

| Differences | Bitcoin | Ethereum |

| Purpose and Use Case | Bitcoin was the first cryptocurrency and was primarily designed as a digital currency. Its main purpose is to serve as a medium of exchange, allowing users to send and receive value in a decentralized and secure manner. Bitcoin is often referred to as "digital gold" and is viewed as a store of value and a hedge against inflation | Ethereum, on the other hand, is a decentralized platform for creating decentralized applications (DApps) and executing smart contracts. While it has its cryptocurrency called Ether (ETH), its primary focus is to enable developers to build decentralized applications and smart contracts that can automate complex transactions and processes. |

| Blockchain Technology | Bitcoin uses a blockchain to record and validate transactions. It employs a Proof of Work (PoW) consensus mechanism, where miners compete to solve complex mathematical puzzles to add new blocks to the blockchain. This process secures the network and ensures the validity of transactions. | Ethereum also uses a blockchain but is more versatile. It initially used PoW like Bitcoin but is transitioning to a Proof of Stake (PoS) consensus mechanism with Ethereum 2.0. The PoS system relies on validators who are chosen to create new blocks based on the amount of cryptocurrency they hold and are willing to "stake" as collateral. |

| Smart Contracts | Bitcoin's primary function is to facilitate peer-to-peer transactions. While it can support basic scripting, its scripting language is intentionally limited to enhance security. Bitcoin's scripting is not Turing complete, which means it's not suitable for building complex smart contracts. | Ethereum was designed from the ground up to support smart contracts. Smart contracts are self-executing programs with predefined rules and conditions. They can automate a wide range of processes, from financial transactions to supply chain management, making Ethereum a versatile platform for decentralized applications. |

| Development Community | Bitcoin has a large and passionate developer community that primarily focuses on maintaining and improving the security and stability of the Bitcoin network. Changes to the Bitcoin protocol are often slow and carefully considered to maintain the network's stability and security. | Ethereum has a more dynamic and rapidly evolving developer community due to its focus on smart contracts and DApps. This community is continually working on Ethereum's improvement and expansion, leading to frequent upgrades and innovations. |

| Market Capitalization and Adoption | Bitcoin has the largest market capitalization and is the most widely recognized and adopted cryptocurrency. It is often seen as a digital alternative to gold and is used as a store of value and a hedge against economic uncertainty. | Ethereum has the second-largest market capitalization and is a pioneer in the world of smart contracts and decentralized applications. It has a broader range of use cases beyond being a digital currency, and its adoption is growing in industries such as DeFi, NFTs, and more. |

In summary, while Bitcoin and Ethereum are both blockchain-based cryptocurrencies, they have different primary purposes and use cases. Bitcoin is primarily a digital currency and store of value, while Ethereum is a platform for building and executing smart contracts and decentralized applications. These differences in purpose, technology, and community have led to distinct roles and characteristics for each cryptocurrency.

Historical context on the creation of Ethereum.

The creation of Ethereum is a significant chapter in the history of blockchain and cryptocurrency, and it was driven by a desire to expand the capabilities of blockchain technology beyond what Bitcoin had to offer. Here's some historical context on the creation of Ethereum:

Background:

Bitcoin's Success: In the early days of cryptocurrencies, Bitcoin had already demonstrated the potential of blockchain technology as a decentralized and secure system for transferring digital value. It served as a digital currency and store of value, but its scripting language was intentionally limited for security reasons.

Desire for Programmable Blockchain: Bitcoin's limited scripting language made it challenging to create complex applications and smart contracts. Developers and visionaries began to explore the idea of a blockchain that could execute more sophisticated code automatically.

Vitalik Buterin's Vision:

Early Involvement: Vitalik Buterin, a young and highly talented programmer and writer, was deeply involved in the Bitcoin community. He wrote articles, contributed to Bitcoin Magazine, and developed an interest in blockchain technology.

Proposal for a New Platform: In late 2013, Buterin proposed the idea of a new blockchain platform that would go beyond the limitations of Bitcoin. He envisioned a blockchain that could run decentralized applications and smart contracts, which he detailed in the Ethereum whitepaper published in late 2013.

Crowdfunding for Ethereum: To turn his vision into reality, Buterin and a team of co-founders conducted a crowdfunding campaign in mid-2014. They sold Ether (ETH) tokens, the cryptocurrency that would power the Ethereum network, to raise funds for development.

The Ethereum Network Launch:

Development and Testing: Ethereum's development team, led by Buterin, worked diligently on creating the platform. The network went through several test phases, including Olympic, Frontier, and Homestead, to ensure stability and security.

Frontier Launch: Ethereum's mainnet (Frontier) was launched on July 30, 2015. This marked the beginning of Ethereum's journey as a live blockchain platform, allowing developers to build decentralized applications and execute smart contracts.

Ethereum's Impact:

Smart Contracts and DApps: Ethereum's introduction of the Ethereum Virtual Machine (EVM) allowed for the execution of smart contracts, which automate transactions and processes. This innovation spurred the creation of decentralized applications (DApps) in various industries, including finance, supply chain, gaming, and more.

Ethereum's Influence: Ethereum's success and innovative capabilities have had a profound impact on the blockchain and cryptocurrency space. It paved the way for the development of other blockchain platforms that support smart contracts and DApps.

Upgrades and Ethereum 2.0: Ethereum continues to evolve, with significant upgrades planned for Ethereum 2.0. This transition involves moving from a Proof of Work (PoW) consensus mechanism to a Proof of Stake (PoS), which aims to enhance scalability, security, and sustainability.

Ethereum was created as a response to the limitations of Bitcoin's scripting language, with Vitalik Buterin's vision of a more versatile blockchain platform. Its successful launch in 2015 marked the beginning of a new era in blockchain technology, enabling the development of smart contracts and decentralized applications that have transformed various industries. Ethereum remains a pivotal force in the blockchain and cryptocurrency landscape.

The Ethereum Blockchain

At the core of Ethereum is its blockchain, a distributed ledger that records all transactions and smart contracts. Unlike traditional centralized systems, Ethereum relies on a decentralized network of nodes to validate and record transactions. Ethereum's transition from a Proof of Work (PoW) to a Proof of Stake (PoS) consensus mechanism marks a significant shift toward sustainability and scalability.

The Ethereum blockchain boasts a robust and intricate architecture that underpins its diverse range of decentralized applications (DApps) and smart contracts. At its core, Ethereum employs a decentralized network of nodes, each running an Ethereum client, which collectively maintains the integrity and functionality of the platform.

Ethereum's Consensus Mechanism

Ethereum's consensus mechanism is undergoing a significant transition from Proof of Work (PoW) to Proof of Stake (PoS) as part of Ethereum 2.0 (also known as Eth2 or Serenity). This transition is aimed at addressing scalability, sustainability, and security concerns. Here's an explanation of both consensus mechanisms and the ongoing shift:

| Differences | Proof of Work (PoW) | Proof of Stake (PoS) |

| How it Works: | PoW is the original consensus mechanism used by Ethereum and Bitcoin. Miners compete to solve complex mathematical puzzles, known as proof-of-work, to validate and add new blocks to the blockchain. This process is energy-intensive and requires significant computational power. | In PoS, validators are chosen to create new blocks and validate transactions based on the amount of cryptocurrency they "stake" as collateral. This means that the more cryptocurrency a validator holds, the higher the chance they have to create new blocks and earn rewards. PoS is considered more energy-efficient than PoW. |

| Security: | PoW is known for its high level of security, as it makes it computationally expensive for malicious actors to control the network. | PoS maintains security through the risk of validators losing their staked assets if they attempt malicious actions. This economic incentive discourages dishonest behavior. |

| Scalability Challenges: | However, PoW has scalability limitations, causing slower transaction speeds and high energy consumption. | PoS has the potential to significantly improve the scalability of the Ethereum network. It allows for faster transaction processing and the ability to handle a greater number of transactions per second. |

| Sustainability: | PoS is more sustainable because it does not require the same level of computational power and energy consumption as PoW. This shift aligns with environmental concerns and energy efficiency goals. |

The Transition to Ethereum 2.0

Phases: The transition to Ethereum 2.0 is a multi-phase process, which includes several key upgrades: Beacon Chain, Shard Chains, and the full transition to PoS.

Beacon Chain: The Beacon Chain, which launched in December 2020, is a PoS blockchain that coordinates validators and secures the network. It operates in parallel with the existing PoW Ethereum network.

Shard Chains: Ethereum 2.0 will introduce Shard Chains, which will divide the network into smaller chains (shards) to improve scalability.

Full PoS: The final phase of Ethereum 2.0 will see the complete transition to PoS, phasing out PoW mining entirely.

The Concept of Blocks, Transactions & Role of Miners/Validators.

The concepts of blocks, transactions and the role of miners (in the context of Proof of Work) or validators (in the context of Proof of Stake) are fundamentals to how blockchain networks like Ethereum operate. Here's an explanation of these concepts:

Blocks:

A blockchain is a distributed ledger composed of a sequence of blocks.

Each block is a collection of data, including a list of transactions, a timestamp, a reference to the previous block (except for the first block), and a unique identifier called a "block header".

Blocks are added to the blockchain in a linear, chronological order. Each new block is connected to the previous one, forming a chain of blocks.

Transactions:

Transactions are the core units of data on a blockchain. They represent actions or data exchanges that occur on the network.

In the context of cryptocurrencies like Ethereum, a transaction typically includes:

Sender's address: The address of the person or entity initiating the transaction.

Recipient's address: The address of the intended receiver of the transaction.

Amount: The quantity of cryptocurrency being sent.

Digital signature: These cryptographic signatures verify the authenticity and authorization of the transaction.

Transactions can represent various actions, such as sending cryptocurrency, interacting with smart contracts, or recording data on the blockchain.

Role of Miners (PoW) or Validators (PoS)

Miners (Proof of Work)

In Proof of Work (PoW) blockchains like Bitcoin (as Ethereum is transitioning to Proof of Stake), miners play a central role in maintaining the network's security and adding new blocks to the blockchain.

Miners compete to solve a complex mathematical puzzle by using computational power. This process is known as "mining".

The first miner to solve the puzzle gets the right to create a new block and include a set of transactions in it. This process is called "block creation" or "block mining".

Miners are rewarded with cryptocurrency (e.g., Bitcoin or Ether) for their efforts, which include transaction fees paid by the users.

Miners must invest in expensive hardware and consume significant energy to participate in PoW mining.

Validators (Proof of Stake)

In PoS blockchains like Ethereum 2.0, the role of validators replaces that of miners.

Validators are chosen to create new blocks and validate transactions based on the amount of cryptocurrency they "stake" as collateral. The more cryptocurrency they hold and are willing to lock up, the higher the chance they have to create new blocks.

Validators are motivated by the potential to earn rewards and transaction fees for their participation.

Validators are required to follow the rules of the network, and there is a risk of losing their staked assets if they act maliciously or against the network's interests. This economic incentive ensures network security.

Blocks are containers for recording transactions on a blockchain, and transactions represent actions or data entries on the network.

Ethereum's transition from PoW to PoS through Ethereum 2.0 is a major step forward that reflects Ethereum's commitment to evolving and improving its blockchain technology to meet the needs of a growing and diverse user base.

The Ethereum Virtual Machine (EVM)

The Ethereum Virtual Machine (EVM) serves as Ethereum's computational engine. It's the world's first and foremost smart contract platform, enabling developers to create self-executing contracts with various applications. The EVM runs on every Ethereum node and executes smart contracts using a unique unit called "gas".

The EVM serves as the heart and the core component of Ethereum's smart contract capabilities. It is a critical element that enables the execution of smart contracts and decentralized applications (DApps) on the Ethereum blockchain. Here's an explanation of how the EVM is the foundation for Ethereum's smart contract capabilities:

Execution Environment:

The EVM provides a runtime environment for executing smart contracts. It is a virtual, isolated machine that runs on every Ethereum node, ensuring consistency across the network.

Smart contracts written in high-level programming languages, like Solidity, are compiled into bytecode that is understandable by the EVM.

Turing Complete:

- The EVM is Turing complete, meaning it can compute anything that a Turing machine can. This makes it capable of running complex and versatile smart contracts, which can implement a wide range of logic and functionality.

Deterministic Execution:

- The EVM ensures the deterministic execution of smart contracts. Given the same inputs and starting conditions, the EVM will always produce the same outputs. This is essential for maintaining consistency and trust within the network.

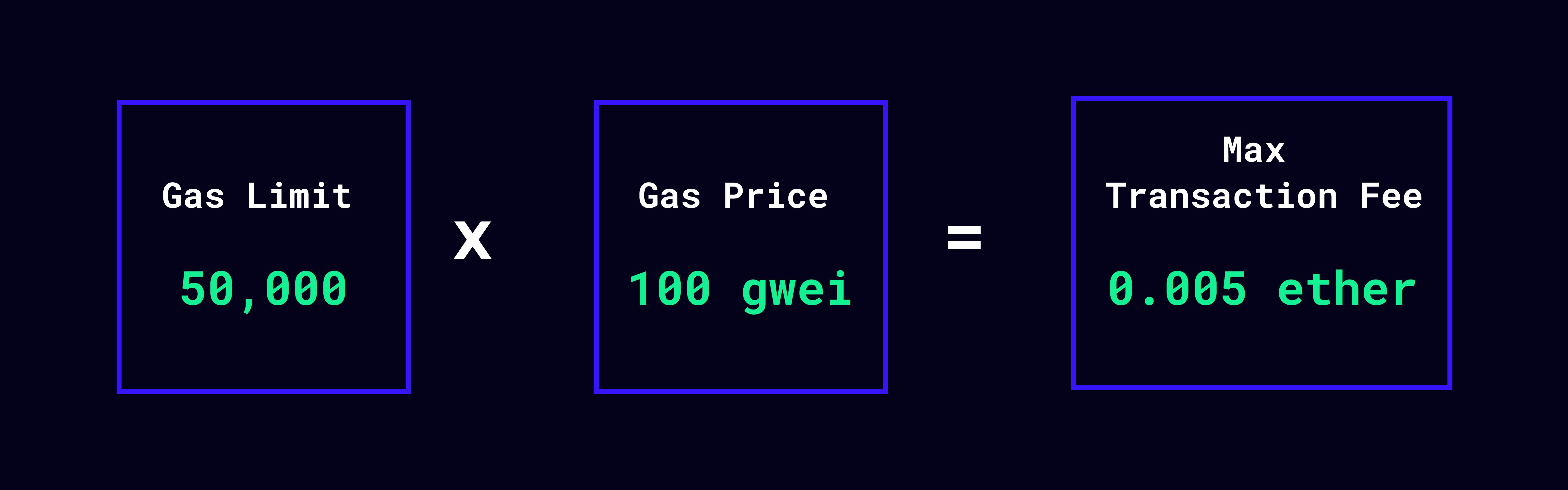

Gas Mechanism:

To prevent spam and ensure network security, the EVM employs a gas mechanism. Gas represents a fee for computation and storage on the Ethereum network. Every EVM instruction consumes a specific amount of gas.

Users pay for gas when they initiate a smart contract or transaction, and this fee is given to miners or validators who execute the contract. If a transaction runs out of gas, the execution is reverted, preventing infinite loops or resource-intensive operations.

Deterministic Outcomes:

- The EVM's deterministic execution and the gas mechanism ensure that smart contracts will always produce predictable outcomes, enhancing security and preventing unexpected behaviors.

Decentralization and Trustlessness:

- The EVM operates on a decentralized network of nodes, ensuring that smart contracts run without relying on a single centralized authority. This trustless and decentralized nature is a key feature of Ethereum.

Global State:

- The EVM maintains a global state, recording the balances and data for all accounts and smart contracts on the Ethereum network. This state is updated with every transaction and smart contract execution.

Interoperability:

- Smart contracts on the EVM can interact with each other and share data. This interoperability allows developers to build complex applications and ecosystems by combining various smart contracts.

Smart Contract Deployment:

- Developers deploy smart contracts to the Ethereum blockchain, making them accessible to users and other smart contracts. Users can interact with these contracts by sending transactions to their addresses.

The Ethereum Virtual Machine (EVM) is the backbone of Ethereum's smart contract capabilities. It provides a secure, deterministic, and decentralized environment for executing smart contracts and DApps. Its turing completeness, gas mechanism, and global state ensure that smart contracts can be versatile, reliable, and trustless, enabling a wide range of applications on the Ethereum network.

Gas plays a crucial role in Ethereum's transaction, it's a mechanism for managing and controlling the computational and storage resources required for transactions and smart contract execution. It plays a pivotal role in network security, resource allocation, and user control, making Ethereum a reliable and efficient blockchain platform. Users pay for gas to cover these resources, and transactions with higher gas prices are prioritized by miners or validators. Gas limits define the maximum resources a transaction can consume, and running out of gas reverts a transaction while still incurring fees for the resources used. Overall, gas helps maintain network security and efficient resource allocation.

Smart Contracts on Ethereum

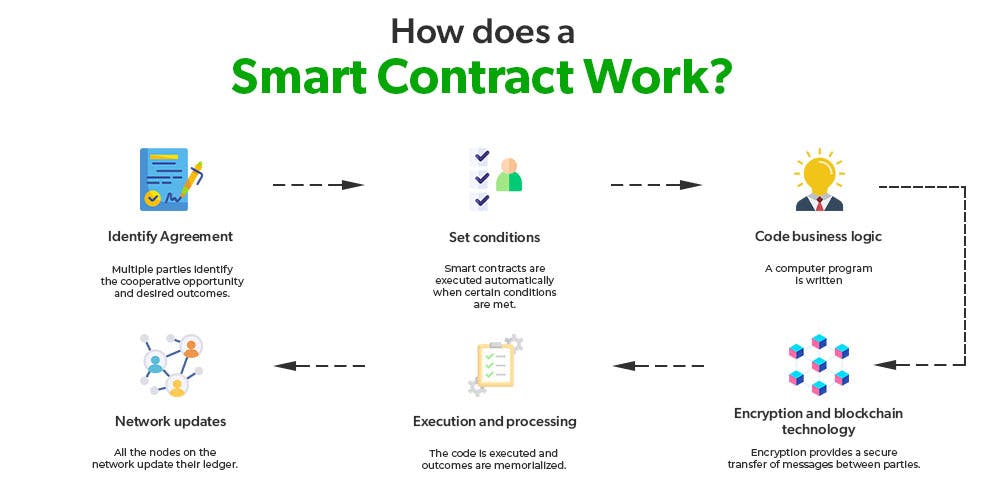

Smart contracts are self-executing, tamper-proof agreements written in code. They automatically execute when predefined conditions are met, without the need for intermediaries. Smart contracts are stored on a blockchain, making them immutable and tamper-proof. They eliminate the need for intermediaries and ensure trust and transparency in transactions and agreements.

Significance of Smart Contracts.

Trust: Smart contracts automate and self-execute agreements, eliminating the need for trust in intermediaries. Participants can trust the code, not a third party.

Transparency: The terms and execution of smart contracts are visible to all parties on the blockchain, enhancing transparency.

Security: Being immutable and cryptographically secured, smart contracts are resistant to fraud and tampering.

Efficiency: Smart contracts reduce the time and cost associated with traditional contract enforcement by automating processes.

Reduced Errors: Automation reduces the risk of human error in contract execution.

Real-World Use Cases.

Decentralized Finance (DeFi): Ethereum is a hub for DeFi, offering smart contracts for lending, borrowing, trading, and yield farming. Projects like Compound and Aave use smart contracts to create decentralized lending markets.

Non-Fungible Tokens (NFTs): NFTs represent ownership of unique digital assets. Ethereum-based NFT smart contracts enable the creation, transfer, and trading of digital art, collectibles, and virtual real estate.

Supply Chain Management: Smart contracts can track and verify the authenticity and origin of products, improving transparency in supply chains. Projects like VeChain utilize Ethereum for this purpose.

Tokenization of Assets: Real-world assets, like real estate or stocks, can be represented as tokens on the Ethereum blockchain. This allows for easier trading, fractional ownership, and increased liquidity.

Decentralized Autonomous Organizations (DAOs): Ethereum smart contracts enable the creation of DAOs, which are self-governing entities where members vote on decisions. Examples include The DAO and MakerDAO.

Gaming: Ethereum's blockchain is used for blockchain-based games and virtual worlds. Smart contracts handle in-game items, assets, and transactions. Games like Axie Infinity and Decentraland are prominent examples.

Identity Verification: Smart contracts can facilitate secure, self-sovereign identity verification without relying on central authorities.

Content Publishing: Decentralized content platforms like Steem and Hive use Ethereum-based smart contracts to reward content creators and curators.

Escrow Services: Ethereum smart contracts can be used for escrow services in various industries, including real estate, legal, and freelance work.

Cross-Border Payments: Ethereum smart contracts can facilitate cross-border payments and remittances with reduced fees and faster settlement times.

Smart Contracts execution on the EVM.

Smart contracts are coded and executed on the Ethereum Virtual Machine (EVM), which is the decentralized computational engine at the heart of the Ethereum blockchain. Here's an explanation of how smart contracts are coded and executed on the EVM:

1. Coding Smart Contracts:

Smart contracts are typically written in high-level programming languages that are specifically designed for Ethereum, such as Solidity, Vyper, or Serpent. Solidity is the most widely used language for Ethereum smart contract development.

Developers write the code for the smart contract, defining the rules, conditions, and behaviors of the contract. This code is saved as a .sol (Solidity) file.

The smart contract code includes functions, variables, and logic that determine how the contract behaves when executed.

2. Compiling the Code:

- The high-level code is compiled into bytecode, which is a low-level, machine-readable representation of the smart contract. This bytecode is generated using a compiler like the Solidity compiler (solc).

3. Deployment:

To deploy a smart contract on the Ethereum blockchain, a transaction is created that contains the bytecode of the smart contract, along with any initial parameters the contract might require.

When a user initiates the deployment transaction, it is broadcast to the network and picked up by miners or validators who include it in a block. This transaction is executed by the EVM, which deploys the smart contract to a specific address on the blockchain.

4. Execution:

Once deployed, the smart contract is ready to execute. Users or other smart contracts can interact with it by sending transactions to its address on the blockchain.

To execute a function within the smart contract, a transaction is created with a specific function call and any required parameters. This transaction is then processed by the EVM.

5. EVM Execution:

The EVM reads the transaction and validates it, ensuring that the sender has sufficient funds to cover gas costs.

The EVM then executes the bytecode of the smart contract in a deterministic and isolated environment. It tracks and consumes gas for each computational step and storage operation.

If the transaction runs out of gas before completion, the execution is halted, and all changes are reverted. This ensures that the network remains in a consistent state and prevents infinite loops or resource-intensive operations.

6. State Changes:

- If the smart contract execution completes successfully (i.e., without running out of gas), it may update the state of the Ethereum network. This could involve changing the balances of Ethereum addresses, altering the state of the smart contract itself, or performing other operations defined by the contract's code.

7. Transactions and Events:

- During execution, smart contracts can emit events or return data, which can be read by other contracts or external applications. This allows for interaction and data sharing between different parts of the Ethereum ecosystem.

In summary, smart contracts are coded in high-level languages, compiled into bytecode, deployed to the Ethereum blockchain, and executed by the EVM. The EVM ensures the deterministic and secure execution of smart contracts, tracking gas consumption to prevent resource abuse. Smart contracts play a crucial role in automating processes, enabling trustless interactions, and creating decentralized applications on the Ethereum network.

Decentralized Applications (DApps)

Decentralized Applications, commonly referred to as DApps, are a revolutionary type of software application that runs on a decentralized network, typically a blockchain. These applications are designed to operate without a central authority, making them trustless and resistant to censorship. Examples include decentralized finance (DeFi) platforms, non-fungible tokens (NFT) marketplaces, and more.

Ethereum provides the infrastructure, tools, and ecosystem necessary for developers to create decentralized applications (DApps). With its support for smart contracts, decentralization, global accessibility, and diverse use cases, Ethereum has become a leading platform for DApp development, ushering in a new era of decentralized and trustless applications.

Ethereum's blockchain has seen the development of numerous popular decentralized applications (DApps) across various industries. Some of the most well-known and widely used DApps on the Ethereum blockchain include:

Uniswap: Uniswap is a decentralized exchange (DEX) that allows users to swap various Ethereum-based tokens without relying on a centralized exchange. It's a core component of the decentralized finance (DeFi) ecosystem.

MakerDAO: MakerDAO is a decentralized autonomous organization (DAO) that issues and manages the stablecoin DAI. Users can collateralize their Ether to generate DAI loans, maintaining stability through over-collateralization.

Aave: Aave is a DeFi lending platform that offers users the ability to deposit assets and earn interest or borrow assets with variable and stable interest rates.

OpenSea: OpenSea is a marketplace for NFTs. Users can buy, sell, and trade a wide range of digital assets, including digital art, collectibles, virtual real estate, and more.

Decentraland: Decentraland is a virtual world built on the Ethereum blockchain. Users can purchase, develop, and trade virtual land and assets within the platform.

Chainlink: Chainlink is an oracle network that connects smart contracts with real-world data and external APIs, enhancing the capabilities of smart contracts by providing trusted, decentralized data feeds.

Balancer: Balancer is an automated portfolio management and liquidity provision DApp that allows users to create and manage pools of assets with customizable allocation.

Curve Finance: Curve Finance is a decentralized exchange optimized for stablecoins. It offers low slippage swaps and low fees, making it a popular choice for stablecoin trading.

These DApps span a wide range of use cases, including DeFi, NFTs, gaming, finance, and more. They showcase the diversity and innovation within the Ethereum ecosystem and the real-world utility of blockchain technology and decentralized applications.

Ethereum's Impact on Industries

Ethereum has been at the forefront of blockchain and cryptocurrency adoption, leading to numerous success stories and case studies across various industries. Here are some notable examples:

Defi Boom:

- Ethereum's decentralized finance (DeFi) ecosystem has seen tremendous growth and adoption. Platforms like MakerDAO, Compound, Aave, and Uniswap have locked billions of dollars in assets, enabling users to lend, borrow, trade, and earn interest on their cryptocurrencies.

Non-Fungible Tokens (NFTs):

- NFTs, which are primarily based on the Ethereum blockchain, have gained widespread attention. High-profile NFT sales, including digital art, collectibles, and virtual real estate, have showcased the potential for unique digital asset ownership. Notable examples include the $69 million sale of Beeple's artwork and the popularity of CryptoKitties.

Decentralized Autonomous Organizations (DAOs):

- Ethereum has been a breeding ground for DAOs, where decision-making is democratized through token governance. Successful examples include MakerDAO, which manages the DAI stablecoin, and Yearn Finance, an automated yield farming platform.

Enterprise Adoption:

- Enterprises have shown interest in Ethereum for various use cases. The Enterprise Ethereum Alliance (EEA) includes major companies like Microsoft, JPMorgan Chase, and ConsenSys, working together to explore blockchain solutions.

Supply Chain and Provenance:

- Projects like VeChain and OriginTrail have utilized Ethereum to improve supply chain transparency, tracking products from origin to consumers. This enhances trust and reduces counterfeiting.

Blockchain-Based Gaming:

- Ethereum's blockchain-based games have seen success. Axie Infinity, a game where players collect, breed, and battle fantasy creatures, has become a prominent example. It has a large and active user base and an in-game economy built around Ethereum-based NFTs.

Art and Content Publishing:

- Platforms like Rarible and SuperRare enable artists and content creators to monetize their work through NFTs and decentralized marketplaces.

Identity Verification:

- Self-sovereign identity solutions on Ethereum offer users control over their personal data and identity verification, with projects like uPort and Sovrin providing secure identity services.

Tokenization of Assets:

- Real-world assets, from real estate to fine art, have been tokenized on Ethereum. These tokens represent ownership and can be easily traded and fractionalized.

Decentralized Applications (DApps):

- A multitude of DApps in various industries, such as finance, insurance, and healthcare, have been built on Ethereum. These DApps aim to bring transparency and efficiency to traditional systems.

Decentralized Finance Lending to the Unbanked:

- In regions with limited access to traditional banking, Ethereum-based DeFi platforms have provided opportunities for financial inclusion and access to global financial services.

These success stories and case studies illustrate Ethereum's versatility and its impact on various sectors. Ethereum continues to be a pioneering force in the blockchain space, driving innovation, and offering solutions to longstanding challenges across industries.

Challenges and Scalability

Ethereum, while a pioneering blockchain platform, has faced several significant challenges, with scalability being one of the most prominent. Here, we'll discuss the challenges Ethereum has encountered and the ongoing and proposed solutions to address them:

1. Scalability Issues:

- Ethereum's scalability challenges are primarily related to its ability to handle a growing number of transactions and smart contracts, resulting in network congestion and high gas fees. This limits the platform's capacity for mass adoption.

Ongoing and Proposed Solutions:

Ethereum 2.0 (Eth2): Ethereum is undergoing a transition from the current Proof of Work (PoW) consensus mechanism to Proof of Stake (PoS) as part of Ethereum 2.0. Eth2 introduces Beacon Chain, Shard Chains, and full PoS, which aims to significantly increase scalability by parallelizing transactions and improving network capacity.

Layer 2 Solutions: Various Layer 2 scaling solutions are being developed and implemented on Ethereum. These include solutions like Optimistic Rollups, zk-Rollups, and state channels. These layers reduce the load on the Ethereum mainnet by moving some transactions off-chain while maintaining security.

Plasma: Plasma is a framework for creating sidechains or "child chains" that can handle transactions and execute smart contracts, reducing the load on the Ethereum mainnet. Projects like OmiseGO have explored Plasma-based solutions.

State Rent: To address storage-related scalability issues, Ethereum is considering implementing a "state rent" model where users pay to store data on the blockchain. This discourages indefinite storage of data, freeing up space and reducing network congestion.

EIP-1559: Ethereum Improvement Proposal (EIP) 1559 introduces a new fee structure that aims to make transaction fees more predictable and efficient. This proposal has been implemented in the London Hard Fork.

2. High Gas Fees:

- During periods of high demand, Ethereum has experienced skyrocketing gas fees, making transactions expensive and limiting accessibility for users.

Ongoing and Proposed Solutions:

EIP-1559: As mentioned earlier, EIP-1559 introduces a fee market mechanism that adjusts transaction fees dynamically based on network demand, making fees more predictable and reducing congestion during peak times.

Layer 2 Solutions: Layer 2 scaling solutions, such as Optimistic Rollups and zk-Rollups, aim to offer low-cost and high-speed transaction processing while minimizing gas fees on the Ethereum mainnet.

Off-Chain Transactions: Off-chain scaling solutions, like state channels and payment channels (e.g., the Lightning Network), can be used to conduct off-chain transactions while minimizing gas costs.

3. Environmental Concerns:

- Ethereum, like Bitcoin, has faced criticism due to the high energy consumption associated with Proof of Work (PoW) mining.

Ongoing and Proposed Solutions:

The transition to Ethereum 2.0 (Eth2) to implement Proof of Stake (PoS) is a significant solution to reduce energy consumption, as PoS is much more energy-efficient compared to PoW.

Efforts to reduce carbon emissions and promote sustainability are becoming increasingly important, and Ethereum's transition to PoS aligns with these goals.

4. Security and Network Upgrades:

- Ensuring the security and successful implementation of network upgrades, such as hard forks, is essential for the Ethereum ecosystem's stability.

Ongoing and Proposed Solutions:

Eth2 is being introduced through a series of carefully planned phases, each undergoing rigorous testing and verification to ensure a smooth transition and maintain network security.

The Ethereum community is actively engaged in researching, testing, and refining upgrade proposals through the Ethereum Improvement Proposal (EIP) process to address security and functionality concerns.

Ethereum has faced scalability challenges, high gas fees, environmental concerns, and security considerations. The ongoing transition to Ethereum 2.0, alongside Layer 2 solutions and various upgrade proposals, represents a concerted effort to address these challenges and ensure Ethereum remains a robust and scalable blockchain platform. Ethereum's ability to adapt and evolve is a testament to its commitment to addressing these issues and improving the overall user experience.

Ethereum 2.0 and the Future

Ethereum 2.0 (Eth2), also known as Serenity, is a major upgrade to the Ethereum blockchain. It represents a fundamental shift in the network's architecture, transitioning from a Proof of Work (PoW) consensus mechanism to a Proof of Stake (PoS) model. This upgrade aims to address several critical issues faced by the current Ethereum network, such as scalability, energy efficiency, and network security.

Key Components and Goals of Ethereum 2.0:

Proof of Stake (PoS): Eth2 replaces PoW with PoS, reducing energy consumption and making the network more environmentally friendly. PoS validators, known as "stakers," are chosen to create new blocks and validate transactions based on the amount of cryptocurrency they hold and are willing to "stake" as collateral.

Sharding: Eth2 introduces a concept called "sharding," which divides the Ethereum network into smaller, parallel chains called "shard chains." Each shard chain operates independently, processing its transactions and smart contracts. This parallelization greatly enhances network scalability.

Beacon Chain: The Beacon Chain is the backbone of Eth2, coordinating the network's validators and managing the PoS protocol. It also introduces cross-linking between shard chains and the main chain, improving interoperability and security.

eWASM: Ethereum 2.0 will support the Ethereum WebAssembly (eWASM), enabling developers to write smart contracts in multiple programming languages, improving compatibility and reducing the need for complex language-specific virtual machines.

Potential Impact and Future Speculation:

Scalability: Eth2's sharding and PoS implementation are expected to significantly increase the network's transaction processing capacity, potentially allowing Ethereum to compete with traditional financial systems and payment processors in terms of scalability and speed.

Reduced Environmental Impact: The transition to PoS is a response to growing concerns over the energy consumption associated with PoW networks. Eth2's eco-friendly approach aligns with sustainability goals and may appeal to organizations and individuals seeking environmentally responsible blockchain solutions.

Diverse Use Cases: Ethereum's smart contract capabilities will remain a central component of Eth2, making it a versatile platform for DApps and DeFi projects. The improved scalability can drive innovation in various industries, from finance to supply chain management.

Interoperability: Eth2's design emphasizes interoperability between shard chains and the main chain, potentially enabling the seamless exchange of assets and data across different shards. This can lead to a more integrated blockchain ecosystem.

Developer Adoption: Eth2 simplifies the development process with its support for multiple programming languages and improved tooling. This may attract a broader community of developers, fostering innovation and new use cases.

Community Involvement: Ethereum's active and diverse developer community is deeply engaged in the Eth2 upgrade. Collaboration and community support are strong, creating a positive environment for Ethereum's future growth and development.

Competition and Collaboration: Ethereum continues to face competition from other blockchain platforms, but it also collaborates with them on cross-chain projects and shared standards, strengthening its position in the blockchain ecosystem.

While Ethereum 2.0 presents promising solutions to the challenges faced by Ethereum, it's important to note that the transition is a complex and phased process, and the timeline for its full implementation may vary. The success of Ethereum 2.0 depends on the successful execution of its roadmap, community support, and ongoing development efforts.

As Ethereum evolves, its role in the blockchain ecosystem is likely to remain influential, serving as a cornerstone for decentralized applications, DeFi, and the broader world of blockchain technology. Ethereum's ability to adapt, scale, and address its challenges is a testament to its enduring importance in the rapidly evolving blockchain space.

Conclusion

Ethereum, along with its core component, the Ethereum Virtual Machine (EVM), has been a driving force in the world of blockchain technology. Their significance cannot be overstated, and they continue to shape the future of decentralized applications and the broader blockchain ecosystem.

The EVM serves as the computational engine powering Ethereum, ensuring the secure and deterministic execution of smart contracts. It is the heartbeat of the Ethereum network, providing a level of decentralization and security that is critical for building trustless systems.

As we look to the future, Ethereum is undergoing a major upgrade to Ethereum 2.0 (Eth2), which promises to address scalability, environmental concerns, and interoperability. This transition signifies Ethereum's commitment to adapt, evolve, and remain at the forefront of blockchain innovation.

Encouraging further exploration and adoption of Ethereum and the EVM will help increase their potential to revolutionize industries, provide financial access to the underserved, and create a more transparent and equitable world is immense. Whether you're a developer, investor, or enthusiast, the Ethereum ecosystem offers opportunities for growth and impact.

References

Socials

If you enjoyed this article ❤️, recommend sharing this article with your peers and don't forget to check my social-media handles.