Unveiling the Next Chapter in Layer 2 Scaling: Polygon's Evolution from PoS to zkEVM Validium.

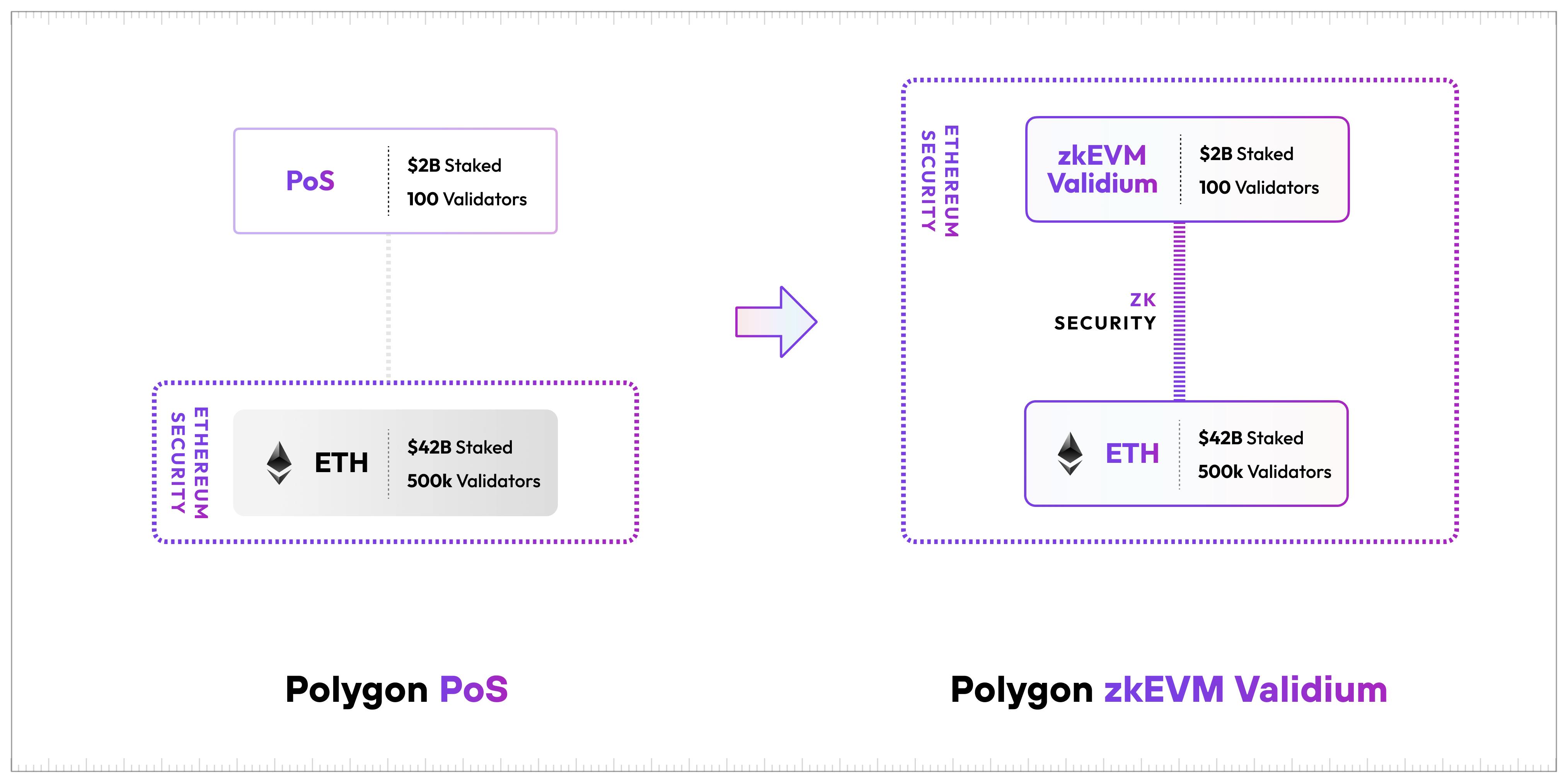

Polygon Labs has suggested a significant improvement to Polygon PoS, with the goal of converting it into a zkEVM Validium, a one-of-a-kind decentralized L2 solution secured by zero-knowledge (ZK) proofs. Polygon's technological leadership is highlighted in this proposal, as proven by the development of the industry's quickest ZK proving system and the introduction of the sole EVM-equivalent zkEVM on Mainnet. It is intended to have far-reaching repercussions for Polygon 2.0 and the wider ecosystem, promising increased scalability, enhanced security, and a more efficient platform for users and developers, as well as components that will contribute to the ecosystem's future growth and success. Let's dive in.

Introduction

Vision.

Polygon Labs introduction of Polygon 2.0 marked a vision for unlimited scalability and unified liquidity, powered by ZK technology. Although Polygon PoS currently relies on its own validators for security, not ZK proofs, it remains a crucial part of the Polygon ecosystem due to its popularity and low fees. To align with the Polygon 2.0 vision, the goal is to upgrade Polygon PoS seamlessly to leverage advanced ZK technology, maintaining user experience and low fees while enhancing security and interoperability with other chains in the ecosystem through zkEVM Validium.

zkEVM Validium.

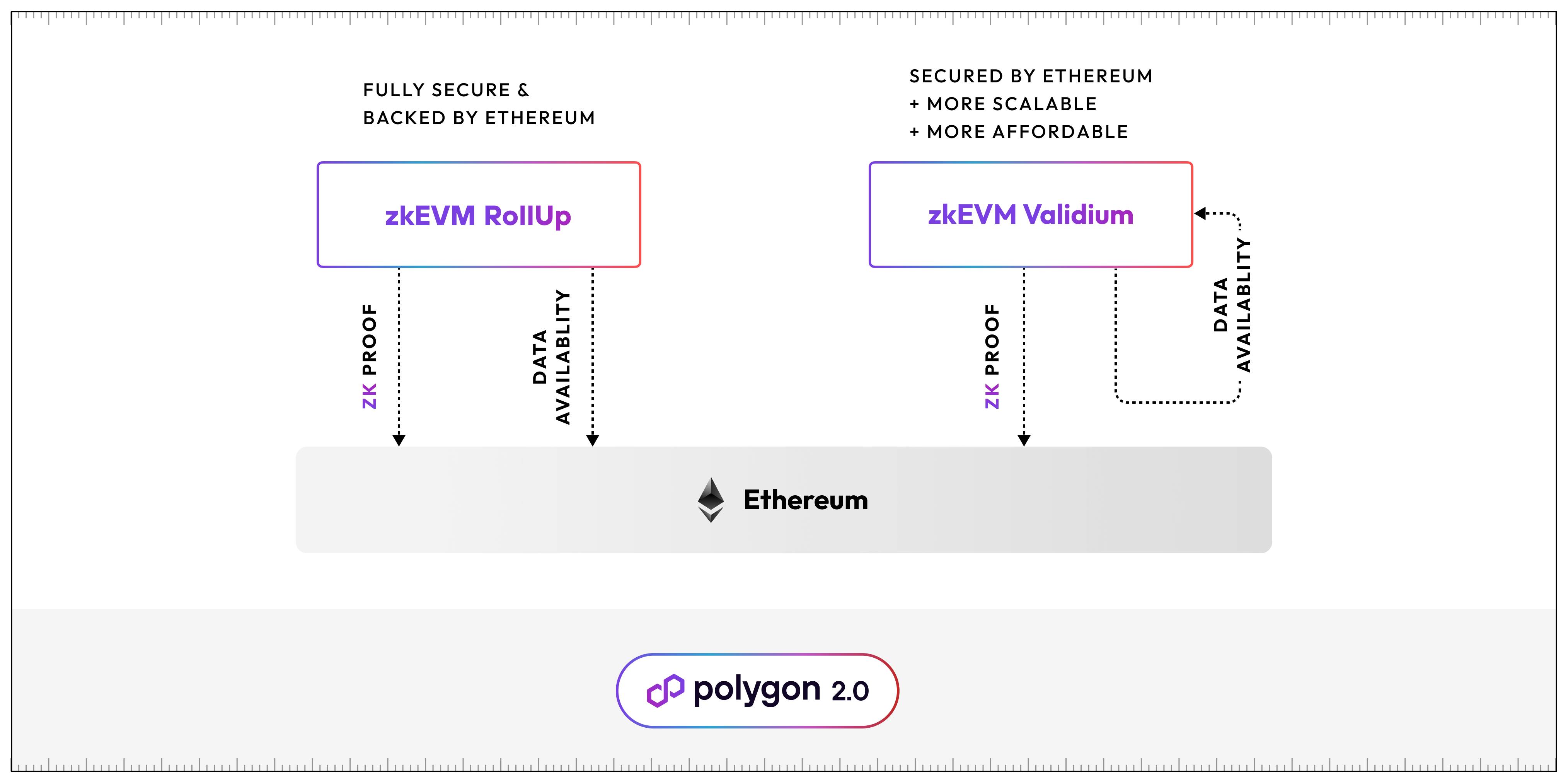

Validium are the rollup's low-cost, high-throughput siblings. Rollups like Polygon zkEVM use Ethereum to broadcast transaction data and validate proofs, allowing them to fully benefit from its unmatched security and decentralization.

The disadvantage of rollups is that posting transaction data to Ethereum is costly and restricts throughput. Validium provide comparable security guarantees to rollups (ZK proofs ensure transaction validity), but transaction data is made available off-chain.

Validiums have two major advantages over rollups as a result of this:

Fees are significantly cheaper since they do not use pricey Ethereum gas, i.e., blockspace, to store transaction data.

Significantly more scalability, because the throughput of rollups is limited by the amount of transaction data that can be published to Ethereum.

In the long run, the only additional cost to running Polygon PoS as a zkEVM Validium would be the cost of generating proofs, and Polygon Labs' ZK teams have already made tremendous work in reducing these costs. The cost of proving a 10 million gas batch on Polygon zkEVM is about $0.0259, or $0.00005 per transfer.

The disadvantage of Validium is that they must secure the availability of transaction data outside of Ethereum, which can be difficult. Fortunately, Polygon PoS already has a decentralized validator set of 100+ validators with a stake of $2 billion, which may serve as a very safe and dependable guarantee of data availability.

Challenges with PoS

It's vital to emphasise that the proposal will have no effect on how consumers or developers interact with the Polygon PoS network.

Polygon PoS will remain the low-cost destination for customers, and the deployment of a ZK tech-stack will not necessitate any smart contract retooling for developers. Node operators and validators, like all Polygon PoS upgrades, would just need to upgrade to the most recent version of the Polygon PoS client software.

The staked token would remain $MATIC for validators, and the chain economics would stay unchanged.

Transition to zkEVM Validium

Following the upgrade, current Polygon PoS validators will play two critical roles:

ensuring data availability.

sequencing transactions.

First, the existing Polygon PoS consensus method already ensures data availability; validators certify to the validity of transactions and the availability of transaction data. Validators will continue to attest to data availability following the change, making Polygon PoS the first Validium with decentralized and secure data availability assurances.

Second, Polygon PoS validators would run the chain by determining which transactions to include in a block and in what order to include them. This is crucial for maintaining decentralization, as transaction fees will continue to flow to $MATIC-staked validators. Polygon PoS would be the first L2 with a decentralized sequencer set.

Benefits and Use cases

Polygon PoS and Polygon zkEVM rollup are the two public networks of the Polygon ecosystem at the moment. That would continue after the update, with the extra benefit of both networks employing cutting-edge zkEVM technology, one as a rollup and the other as a Validium.

We believe the two networks can coexist and compliment one another:

Polygon zkEVM rollup already provides the maximum level of security, but at a little greater cost and with limited throughput. It is an excellent fit for applications that execute high-value transactions and prioritize security, such as high-value DeFi apps.

Polygon PoS (zkEVM Validium) would provide extremely high scalability and very low fees. It would be ideal for applications with high transaction volumes and cheap transaction fees, such as Web3 gaming, social, and micro DeFi.

Conclusion

Last week, I published an article explaining the vision for Polygon 2.0, where Polygon Labs aims to establish Polygon as the Value Layer of the Internet—a foundational protocol that will allow anyone to create, exchange, and program value the same way the Internet allows anyone to create and exchange information.

This upgrade would be an important step toward creating the Value Layer, given that it would allow the entirety of Polygon PoS users, assets, and state to migrate to the Polygon 2.0 ecosystem.

The Pre-PIP is already up and running on the governance forum. If it receives significant support, i.e. community consensus, a formal PIP (Polygon Improvement Proposal) will be submitted, kicking off the PIP-1 and PIP-8 processes. The PIP will subsequently be addressed on PPG (Polygon Protocol Governance) Calls, governance forums, and other public venues in order to gain consensus from all ecosystem members. If agreement is secured, the implementation might go live on Mainnet by the end of the first quarter of 2024.

Socials

If you enjoyed this article ❤️, recommend sharing this article with your peers and don't forget to check my social-media handles.